Today at 11am, Finance minister Nirmala Sitharaman will be announcing general budget for 2026 - 2027 in parliament. We are expecting huge volatility in markets during his speech. Stocks and sectors that will have biggest impact will be: Agriculture, Banking, Infrastructure, Metals, Financials and Defence. From agriculture sector we see, Jain Irrigation system (JISLJALEQS) as foremost pick. We are ... [Continue Reading]

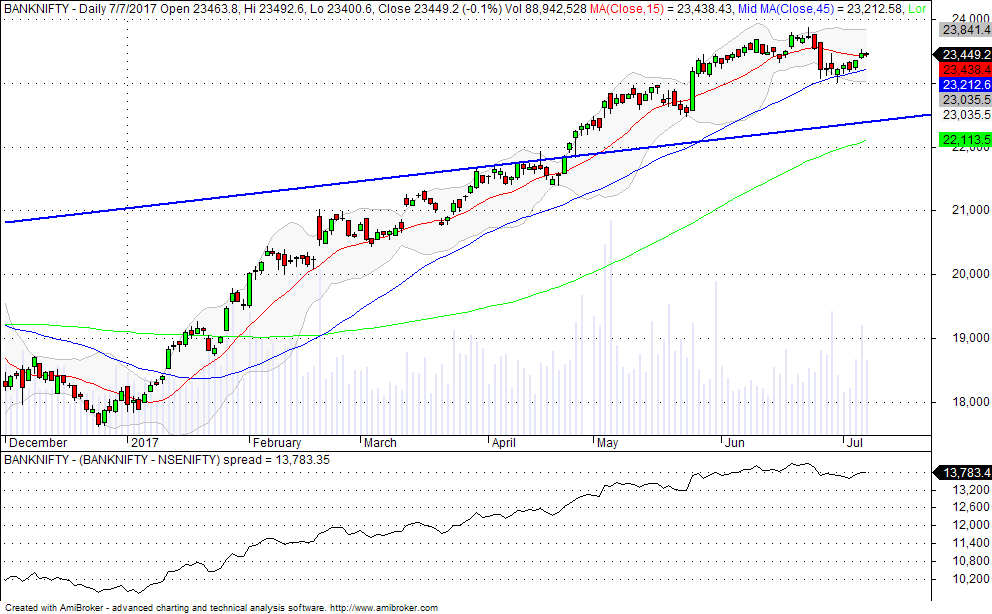

Bank Nifty and Banking sector outlook for short term

Bank nifty and Nifty futures has been trading higher for almost 1.5 years. This all started back in the month of September 2013 when Shri Narendra Modi was declared as PM candidate of BJP. After registering a massive win by BJP in general election we saw lots of bulls joining the stocks and moving it northward. We are expecting this uptrend to continue until the government is pushing in the ... [Continue Reading]

Private Sector Banking Stocks Looks Attractive: ICICI Bank may Outperform State Bank of India

ICICI Bank Ltd is India's largest private sector bank, operating a huge networks of its branches and ATMs across the country and abroad. Looking at the daily stock chart, we see price action is suggesting consolidation and we are waiting for a confirmed breakout. So our initial strategy would be to enter the buy trade on the positive breakout, we will place our buy entry orders above 1090 level ... [Continue Reading]

Indian Banking Stocks Have Strong Fundamentals: Kotak Bank Can be Strong Stock for Short Term

Kotak Mahindra Bank is a private sector company that was listed on NSE on 20 December 1995, the stock price as on 1999 was about Re.1 per share and as the bull run began it climbed to Rs.719 by January 2008, this is about 719 times returns. Following the stock chart we see that there is long term bullish outlook for KOTAKBANK and we are only looking for the buying opportunity as long the price ... [Continue Reading]