We are conducting FREE Webinar on Option chain analysis for our blog readers. Simply register and we will reserve your seat. Here are the Webinar Details: Date & Time: 20 March 2021, 7:00PM IST Venue: Zoom Meeting We will be closing free registration on 19 March 2021, so make sure you don't miss this opportunity. ... [Continue Reading]

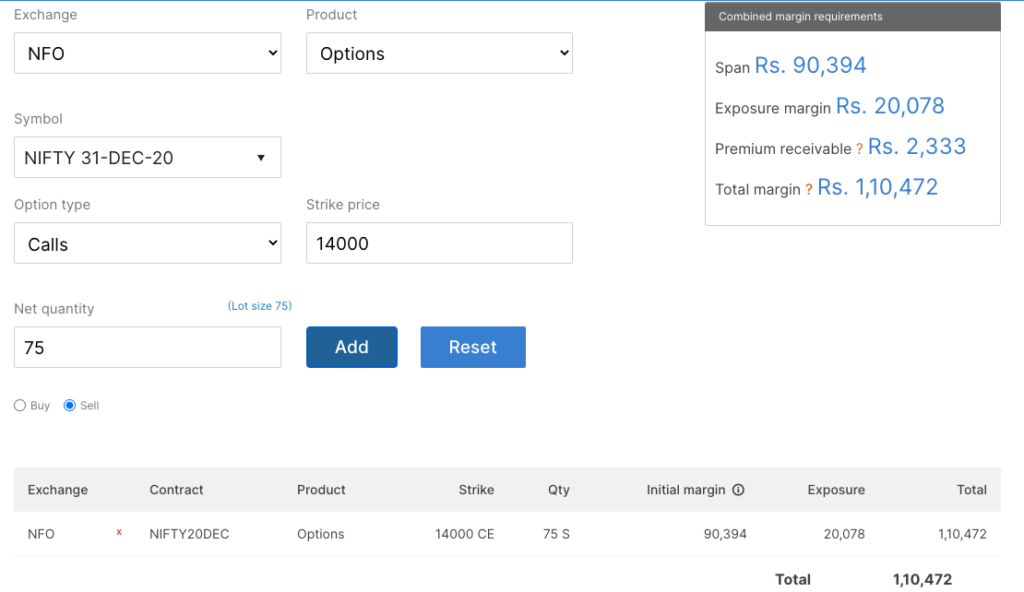

When to short sell Nifty options, how much margin required for Option Selling

Nifty option is the most liquid option contract traded on NSE. Having a daily average turnover of about whooping $186 billion (Rs.15,80,000 crore). Nifty option selling is done when a trader believes that the option is going to expire worthlessly. When the options are really expensive then it is a good time to write nifty options rather than buying options. When the Implied volatility IV ... [Continue Reading]

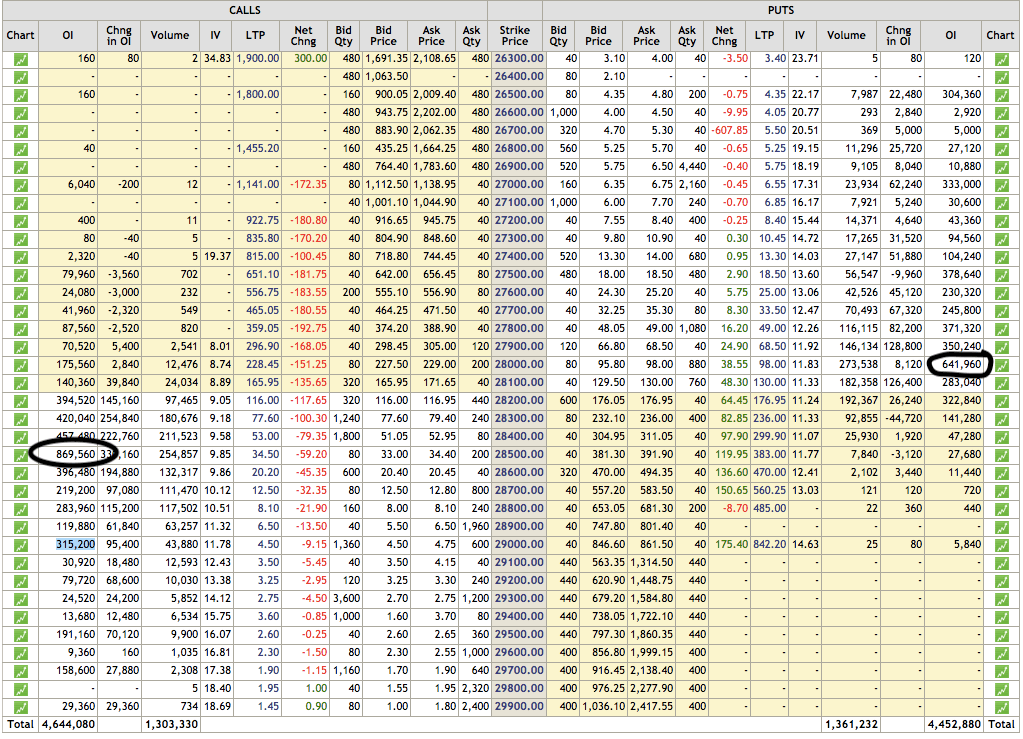

Bank Nifty Option chain trading strategy

Banknifty is one of the highly liquid and actively traded indexes on NSE. Banknifty options contracts also have a weekly expiry, which means you can trade 4 times every month. So bank nifty option chain is very active as well, trading in bank nifty option also requires less margin for option writing. This trading opportunity is unique because this week is having 4 trading sessions (15th August ... [Continue Reading]

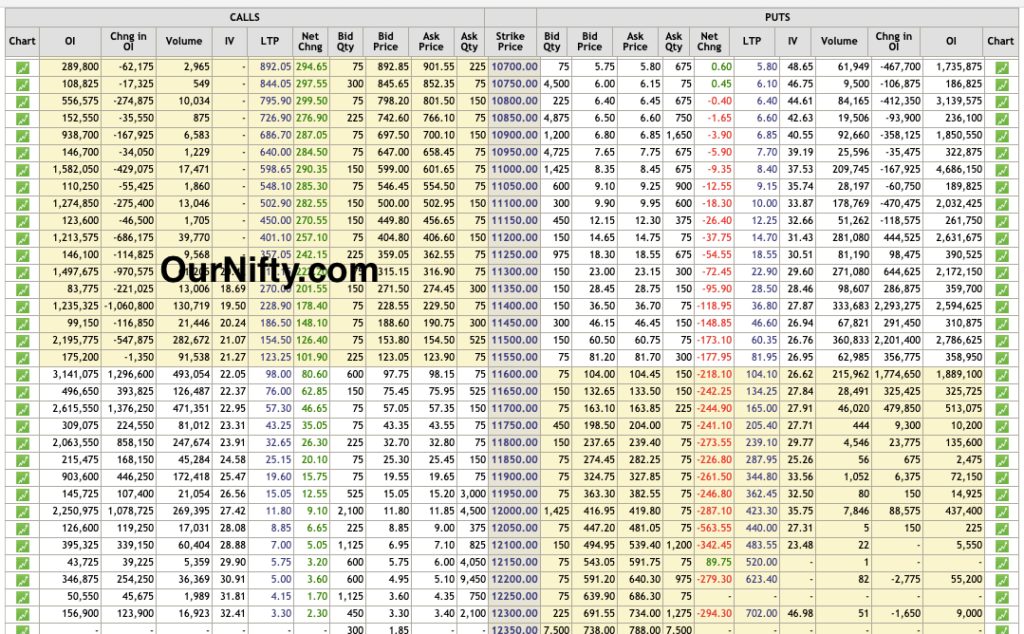

Nifty is bullish, Trade bullish view using nifty option spread Strategy

Nifty is most likely to go higher from the current levels. After the corporate tax cut. We are seeing huge buying in markets. We are expecting nifty has 1-2% upside room still left. But buying a future can be risky. So we are looking for options strategy with defined risk. In nifty one can deploy bull call spread, by buying ATM call option and selling higher strike call. This will bring the ... [Continue Reading]

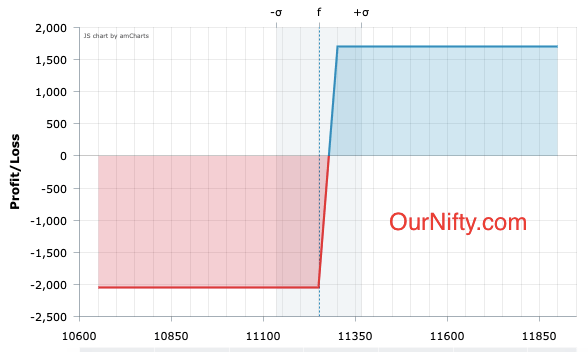

Benefits of Trading with Risk Defined Options Strategies

Risk defined options strategies help to isolate the max risk to a certain comfort level. In trading future, we often place a stop loss to restrict losses. But what if our stop loss doesn't get trigger? scary right! Let us understand the risk with an example... We have found nifty future is trading at a support level, we are quite confident that nifty will not break this support. As it is a ... [Continue Reading]

- 1

- 2

- 3

- …

- 17

- Next Page »