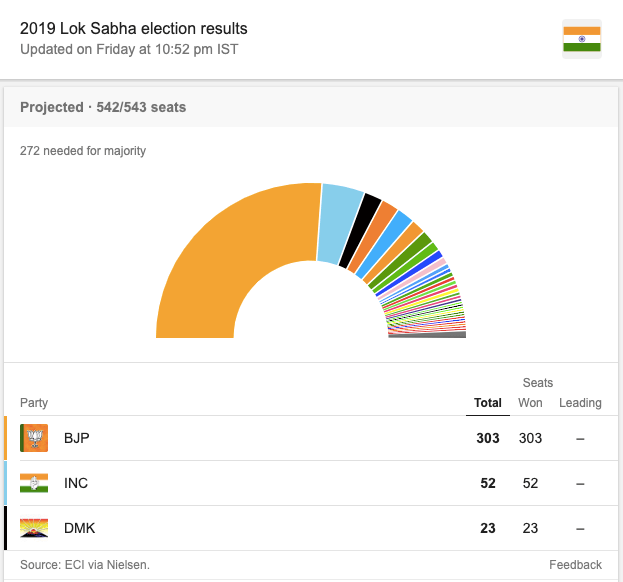

When the last round of polling was complete on 19th May. Most of the exit poll agencies were ready to show who was ahead in 2019 General Election. We saw most of the exit polls predicted BJP led NDA will form the next government. Exit Polls Result: NDA was likely to come back to power, was seen in the exit polls. On Monday we saw Nifty and Banknifty hitting a new all-time high. India VIX ... [Continue Reading]

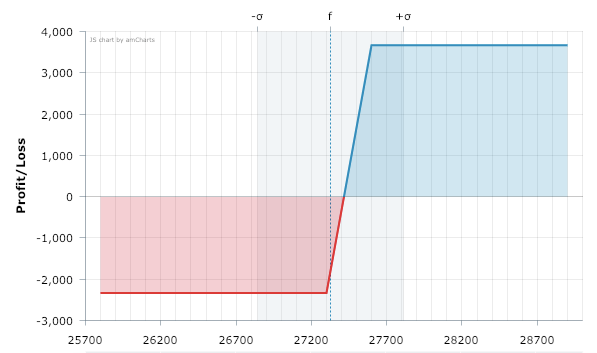

Options Trading Strategies to Deploy for Budget Session

The general budget 2021 will be announced on 1st Feb. I am expecting volatility to be high for a few days. I see IV (implied volatility) is not very high as of now. Moves during the sessions could be wild, so I will not be taking any naked option positions. I am hedging all the open positions, be prepared for uncertainty. Spreads are the best way to trade in the time of uncertainty. I am ... [Continue Reading]

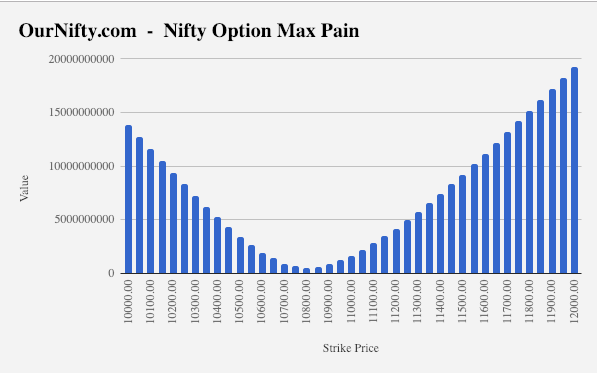

How to trade Nifty Option using Max Pain Level

What is Max Pain level? Max pain level is an option strike price at which index expires on the expiry day. Causing maximum loss to the option buyer and minimum loss to the option seller. Now one thing to note here is, option sellers (option writer) are much smarter than buyers. Selling option requires huge capital to play. So only those guys with deep pockets play in the option writing game. ... [Continue Reading]

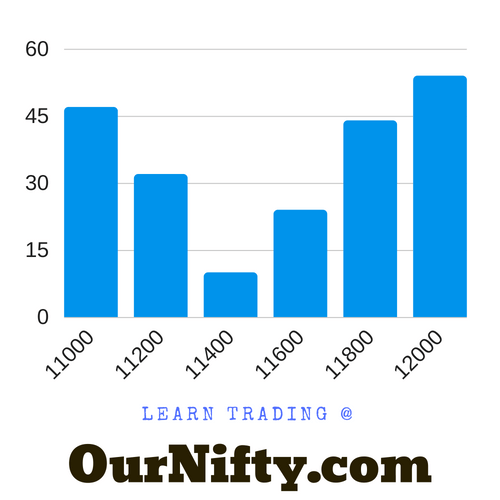

Nifty Option Chain with Option Writing Strategy

The nifty option contract is highly liquid contract traded on NSE. Understanding in which direction the smart money is flowing can help us create a great trade. To find the smart money flow, let us look into the nifty option chain. I personally recommend using one available at nseindia.com. Using Nifty Option Chain data: Then we should look for the strike price having the highest open interest ... [Continue Reading]

Positional Trading with Nifty Options Live Open Interest

Nifty futures has been quite volatile for almost three months now. We are just seeing a sideways move just before a new/fresh upside move. In this type of scenario we find trading in options quite risky, so to improve decision making we have introduced a new trading style in nifty options using Open interest. Yes, by using open interest data correctly any trader can generate handsome ... [Continue Reading]

- « Previous Page

- 1

- 2

- 3

- 4

- …

- 17

- Next Page »