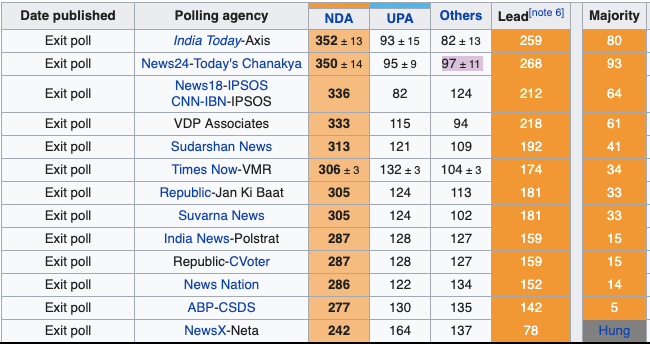

When the last round of polling was complete on 19th May. Most of the exit poll agencies were ready to show who was ahead in 2019 General Election. We saw most of the exit polls predicted BJP led NDA will form the next government.

Exit Polls Result:

NDA was likely to come back to power, was seen in the exit polls. On Monday we saw Nifty and Banknifty hitting a new all-time high. India VIX collapsing almost 23%, reducing the option premium. But this was just exit poll outcome. Markets were up by more than 2.5%, Nifty up 400+ points, Sensex 1300+ points, Banknifty 950+ points.

India VIX Crush on Exit Polls:

Retail traders must have bought a lot of OTM banknifty option or nifty options. As the premium was less for far out of the money options. Banknifty 32000 call was trading at 160. Small traders see this as an opportunity to double the money they invested.

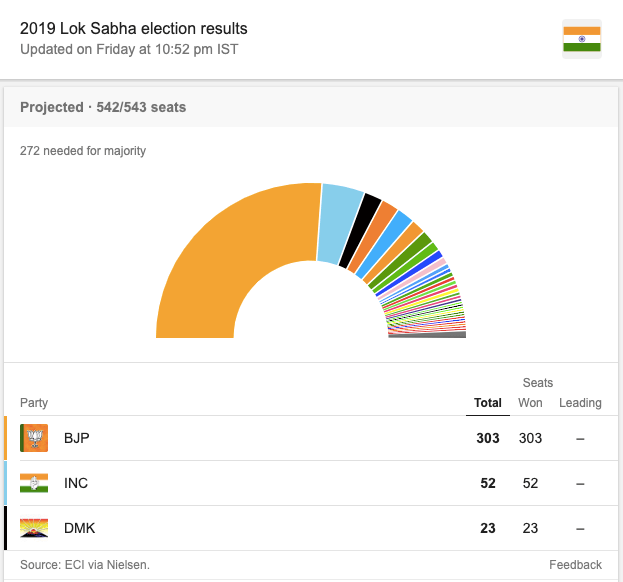

Now on the day of General election 2019 result, the early trends show BJP led NDA was sure to form the next central government. So Modi ji gets his next term as PM again. Even before the markets open the trends clearly gave good confidence of NDA’s victory.

India VIX on Election Result’s Day:

On 23rd May it was results day as well as weekly options expiry for Nifty and Banknifty options. As the markets opened the India VIX fell from 28 to sub 24 level and all the options premium fell by more than 50% just at the opening. Within a few minutes, the VIX was down by 40% and this led option premiums to fall further.

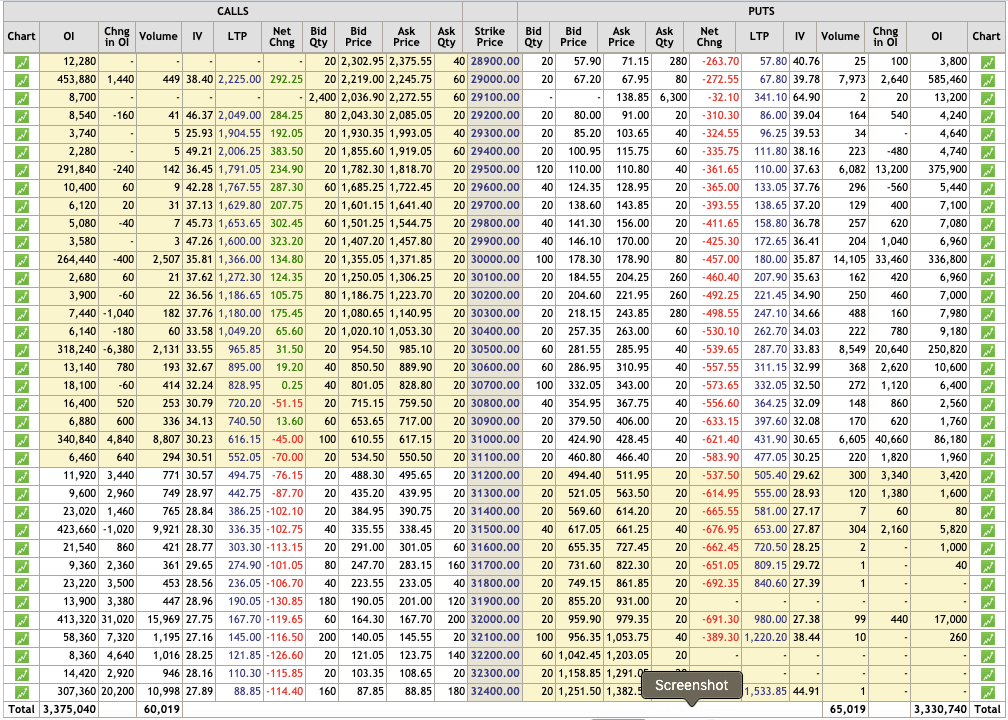

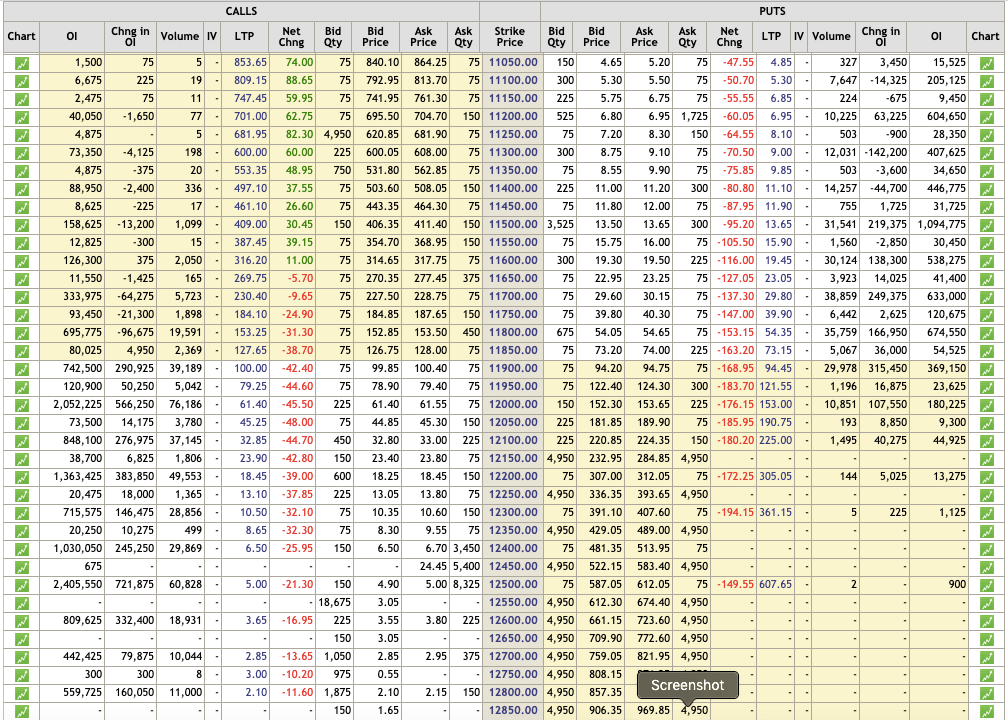

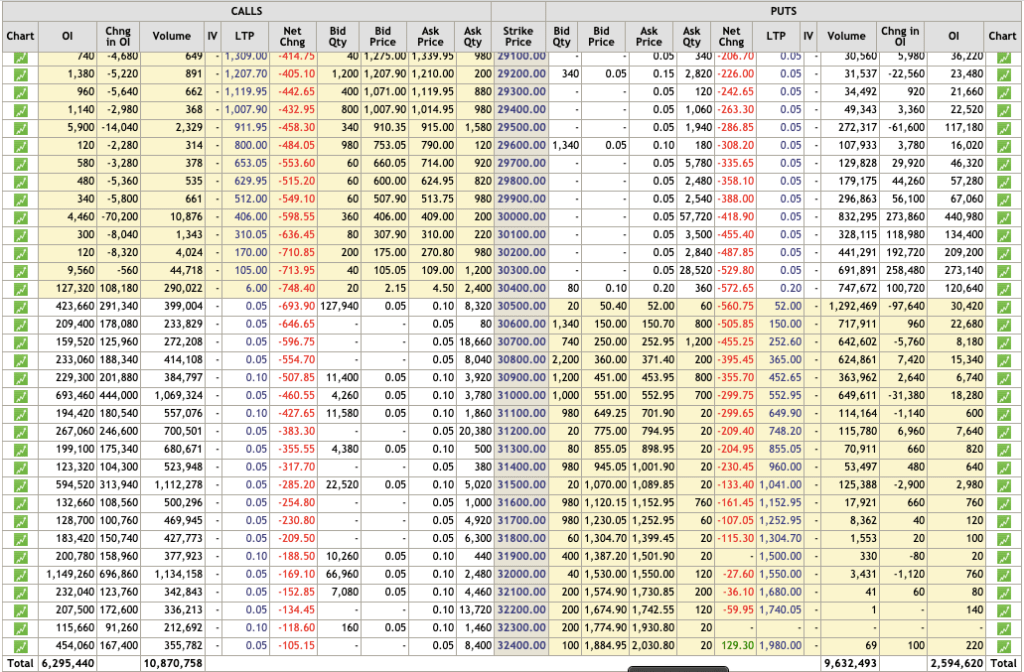

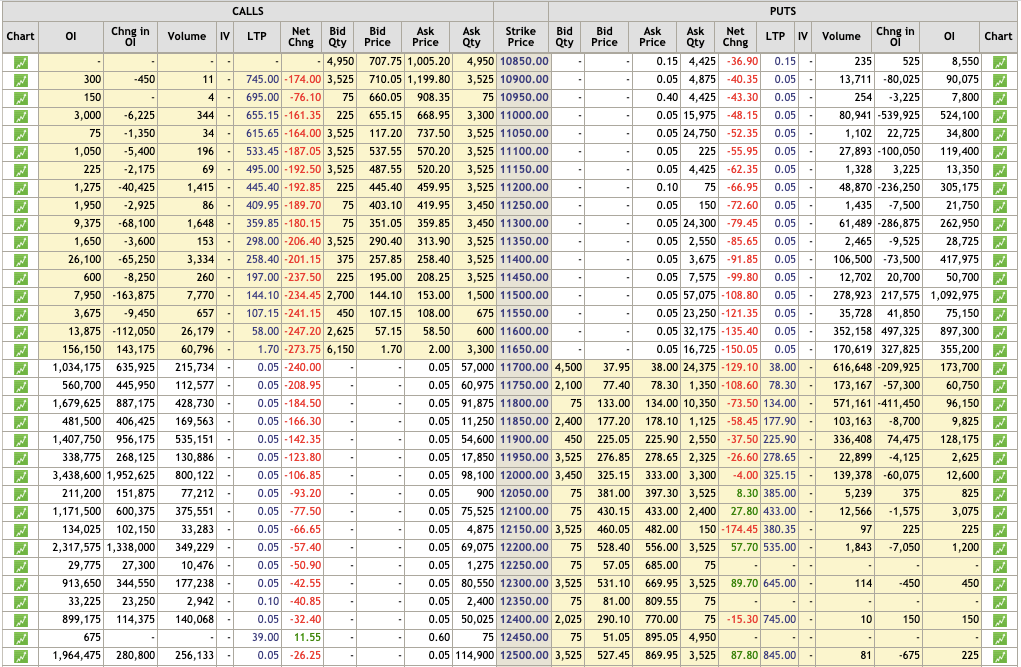

Nifty and Banknifty Option Chain at Market Opening:

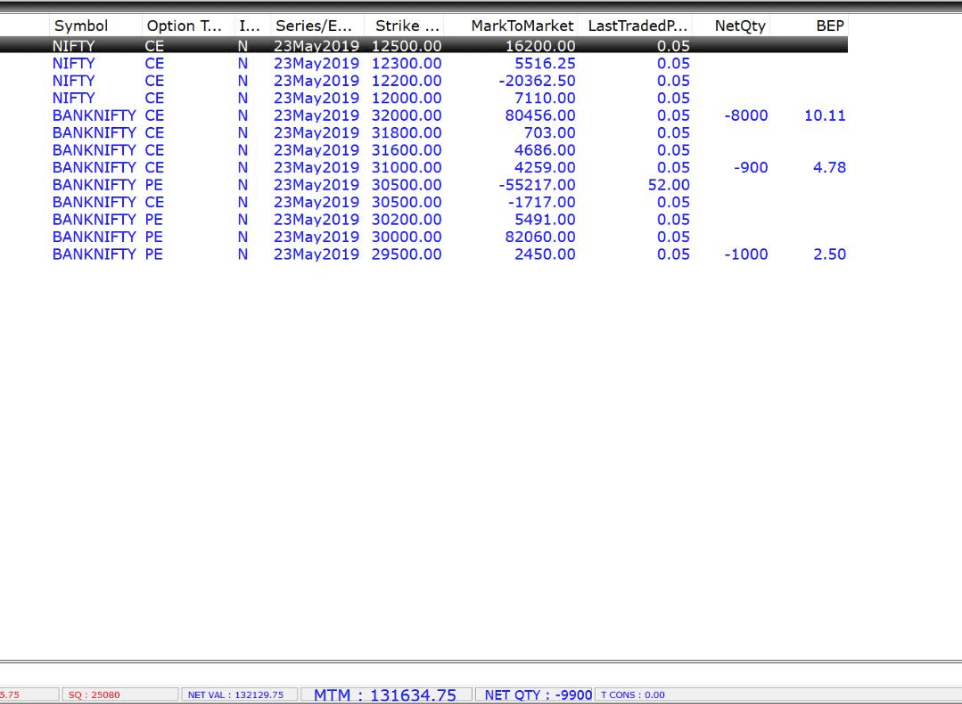

This was the status in the first 15 minutes of the market opening. But at the end of the day, as the expiry approached, the premium fell even faster. Those who thought that 160 priced option will become 320, have lost miserably. All OTM option became 0 (Zero).

2019 Lok Sabha Election Result:

Why both Call and Put Option made Loses?

Well, the answer is options are the most complex instruments traded in the stock market. Price of options is derived from may parameters one of them being Volatility. On the day of the result, the volatility gets crushed as uncertainty is no more in the market. So prices of all options go down. One who buys the option faces this loss, but the option seller would have made money. Got it!!

Option Chain for Weekly Expiry:

All the time premium vanished soon after the Results were out, also the expiry effect was into play. See the below screenshots, how the total premium of both calls and puts for 30500 strike price in bank nifty. Total premium yesterday was 1250 and after the expiry, it was just 50. A fall of 1200 points premium. Isn’t it a huge meltdown?

The option seller and max pain always have a statistical edge over the buyer. Even though Nifty / banknifty was higher by 2%. But call options saw premium erosion. This is due to option greek called Vega or effect of Volatility.

This is how we have traded:

We do teach all these strategies in our Advanced Options Trading Course. Call / WhatsApp / SMS us at +91-9970777789.

If you or any of your relatives have served or serving in Indian Armed Forces, then we will offer a discount on all our courses.

Leave a Reply