Banknifty is one of the highly liquid and actively traded indexes on NSE. Banknifty options contracts also have a weekly expiry, which means you can trade 4 times every month. So bank nifty option chain is very active as well, trading in bank nifty option also requires less margin for option writing.

This trading opportunity is unique because this week is having 4 trading sessions (15th August being Independence day – check holiday calendar). Also, have a look at the bank nifty stocks which have a huge weight in this index.

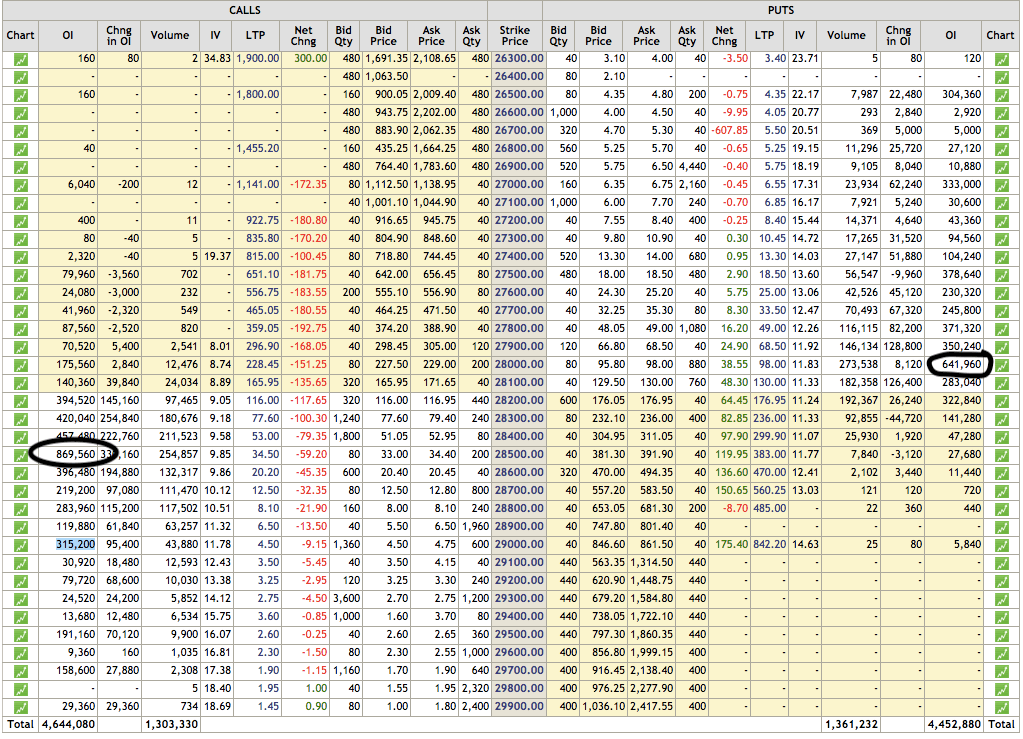

Let us check the bank nifty options chain on nseindia website:

In the option chain, have a look at 2 very important option instruments.:

- Banknifty 28000 call (having highest open interest amongst call option)

- Banknifty 28500 call (having highest open interest amongst put option)

So, these should be the levels of support and resistance. 28000 level should be near-term support whereas 28500 level may act as resistance. Basically, the weekly range for bank nifty will be 28000 to 28500.

Options writers are the smartest species of traders of all the traders, they are very accurate in their analysis. So these support and resistance levels are most likely to hold if there are no surprises in the market.

Bank Nifty option chain trading strategy:

Traders should look for writing call and put options and grab the premium. As the probability of bank nifty to expire in 28000 to 28500 range is quite high. Still, trading is a game purely based on probability, that’s why it is risky.

But to be on the safer side we can keep 100 points buffer to this range and start looking for 27900 put option and 28600 call option.

Stop loss will be to exit this trade if bank nifty breaks 28000 – 28500 range on a closing basis. Here closing basis means if the bank nifty breaks this trading range and it is already 3:25 pm. Then most likely the range is broken and a breakout is confirmed then you should exit from this trade.

Targets should be to grab the entire premium of the options at the time of writing them. So will be holding it till the weekly expiry.

Note: This is a combined trade, so hold both the legs of these options if you are holding. Exit both instruments while you are exiting. The stop-loss that I use for trading options is based on the portfolio. I always have a 3% portfolio stop loss to protect me from a black swan event.

If you want to learn such trading strategies, you should check our Online Options Trading Course and Technical Analysis Course. or simply give me a call on +91-9970777789 for the options trading course.

Very nice and useful information, for Option traders. thanks for Sharing.