What is Max Pain level?

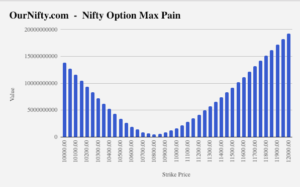

Max pain level is an option strike price at which index expires on the expiry day. Causing maximum loss to the option buyer and minimum loss to the option seller.

Now one thing to note here is, option sellers (option writer) are much smarter than buyers. Selling option requires huge capital to play. So only those guys with deep pockets play in the option writing game. Retail traders are usually one who buys the options, most of the time the naked options.

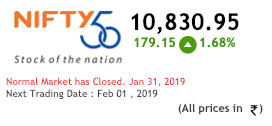

On the expiry day, the nifty or the bank nifty will usually move towards the max pain level. Causing the buyers maximum loss and seller minimum loss. We believe, the big guys manipulate (I didn’t say that) the index in such a way that index expires very close to max pain level.

How to trade using max pain?

After learning about max pain level, we are good to start trading option using max pain level. If the markets are above the max pain level and max pain is not at all moving. Then chances are market will see some selling pressure. So we can look for selling call options as we are expecting the market to cool off.

If the index is trading below the max pain and 2 pm has already passed. Then we can expect the market to see some buying or short covering. What we can do is to look for selling put options having the highest open interest. Selling a put option is always risky as fear spreads faster than the greed. You need to look for protection, buy a put option one strike lower.

Steps by step expiry trading in detail:

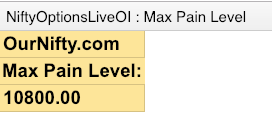

- Check the Max pain level. We are providing the live max pain levels for nifty and bank nifty options analysis.

- Find the highest open interest call and put option strikes.

- If the max pain is between high open interest call and put option strike price, then sell the strangle.

- Keep adjusting the position and make sure none of the strike price become in the money.

- Do not enter the position after 3 pm on the day of expiry.

- In expiry trade, we are expecting out of money options to expire worthlessly and become zero. So we don’t have to square off once we have sold the option.

Check the max pain level:

Check today’s expiry level for Nifty:

If you are new to trading you can learn technical analysis and then options trading course. First, you need to save brokerage by opening a trading account with Upstox.

max pain level is working like a charm. thanks for sharing this free tool

nifty max pain is very stable than bank nifty. banknifty max is moving very fast on the expiry trading day. my personal observation is that, to keep a eye on max pain in last 2 hours of trading on expiry day.

Thanks for sharing live max pain graph and max pain level. I couldnt find a free level like this.

You are welcome jiggy.

I have bought nifty 11000 call option should i hold it till expiry as max pain in nifty is at 11000. or should i book profit right now.

I don’t give advice on taken positions. But I would have booked a profit in that position.

banknifty max pain is not updated for monthly expiry. can you share the monthly expiry max pain level?

Monthly expiry is not possible as of now. You can keep tracking weekly expiry as it is more liquid compared to the weekly series.

Options max pain is very useful tool, thanks for sharing it for free. I am interested in options trading course. can u please provide me the details to my email.

Thanks Dhruv for the feedback.

I have emailed you with the details. Feel free to contact me at 9970777789.

can max pain level be wrong? whats your experience with max pain on the weekly expiry. I have just started trading in index options.

Yes, it can go wrong. Max pain is just a theory, but as per my experience index are very difficult to manipulate. So max pain is most likely to work like magic.

if max pain level is moving higher on expiry day. then can i buy a ATM call option or sell a put option?

I am part time intraday trader, started trading in options. my trading is capital is 1 lac. kindly suggest me the trading strategy.

Better is to sell the puts, you will get benefited from time decay. Don’t buy options on the expiry day, you may lose heavily.

First of all big thank you for providing live max pain level. Can us also provide the levels of stocks with active option chain. Reliance, tatasteel, sbin, icicibank, hdfcbank and itc, etc

Currently, I am working on options for liquid stocks. Once I am done, I will provide them for free here.

Max gain level and open interest for nifty weekly expiry is awesome. it will be great if you start it for stocks also.

Thanks Uday.

I am already working on it.

Options writing is easy when you know the max pain level, especially on the day of expiry. I am able to generate second income using option writing.

When selling options. Be careful you can go terribly wrong and lose money. Always use protection, better is to go with risk defined strategies.

Max pain level is not updating today so can we expect bank nifty to expire at 27000 level? or there is something cooking in market.

For me markets seems to be trading in a range today and tomorrow. lets hope to eat up some theta due to time decay.

sell strangle is making me money consistently every week. I use your max pain tool for trading weekly expiry.

Is this tool showing live data or its a delayed one?

The max pain level is live data from NSE.

Banknifty and nifty options are best to make money. But i am currently stuck in nifty option 11100 call. should i buy more to average or sell and book loss.?

I dont give advice on already taken positions. But I would have booked loss in that trade.

Nifty max pain level is perfect for trading in options. Thanks for sharing this wonderful tool.

Thanks Ashok.

Max pain level is not updated for monthly series. I am able to see only weekly max pain.

Yes, that’s weekly options. Because weekly options are more liquid as compared to monthly series.

As per max pain level it is 27100 for bank nifty but index is trading at 27010. so can we expect market to go higher towards the max pain level. or max pain level will shift downward?

Thanks for sharing this tool

Well, that’s a million dollar question. The only market can tell what will happen. But looking at the current scenario I think the market will bounce from the psychological level of 27000.

I have faced huge loss in nifty and banknifty future trading. But then i started to sell options and now i am able to make profit. but profit is very less. can you tell me few trading strategies which can help me to make high returns in options selling.

Try taking directional trade with spreads. Join our options trading course to learn these trading strategies.

Hi sir, Can you create a excel sheet for max pain of nifty and bank nifty weekly expiry?

Thanks in advance.

I am already working on this for stocks and index options.

Android app for live max pain level and options open interest? do you know any apps as such.

Options open interest data is good tool, i am using it for trading banknifty weekly options. I was able to gain 50% last month trading only banknifty options.