Risk defined options strategies help to isolate the max risk to a certain comfort level. In trading future, we often place a stop loss to restrict losses. But what if our stop loss doesn't get trigger? scary right! Let us understand the risk with an example... We have found nifty future is trading at a support level, we are quite confident that nifty will not break this support. As it is a ... [Continue Reading]

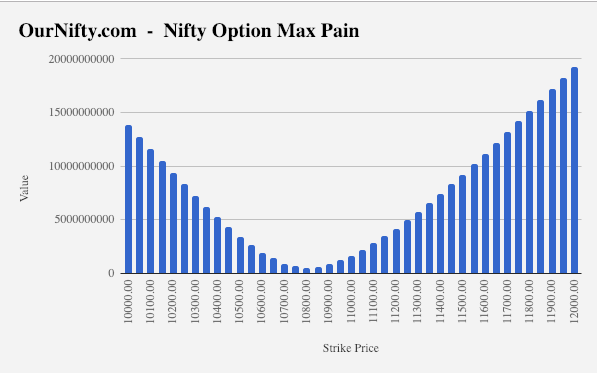

How to trade Nifty Option using Max Pain Level

What is Max Pain level? Max pain level is an option strike price at which index expires on the expiry day. Causing maximum loss to the option buyer and minimum loss to the option seller. Now one thing to note here is, option sellers (option writer) are much smarter than buyers. Selling option requires huge capital to play. So only those guys with deep pockets play in the option writing game. ... [Continue Reading]

Axis Bank to create a All Time High – Derivative and Technical Analysis

Axisbank yesterday has traded around its highest level and was able to close comfortably there. But an all-time high is still 1% away, so what should be our approach? Shall we buy or sell this stock? Axis bank analysis will clear this all. Let us find the answer with technical analysis and by watching derivatives data. Technical analysis on Axisbank: Axis bank has tested its previous high ... [Continue Reading]

How to Select Correct Strike Price for Trading Nifty Options

Secret of success in nifty options trading lies on its strike price that a trader chooses. A strike price in nifty option has much to do with number of days left for expiry. If expiry is near then you select in the money nifty option, if expiry is far away then you may choose out of money nifty option. Here is how I choose the strike price depending on time left for expiry: 1. When expiry is 15 ... [Continue Reading]

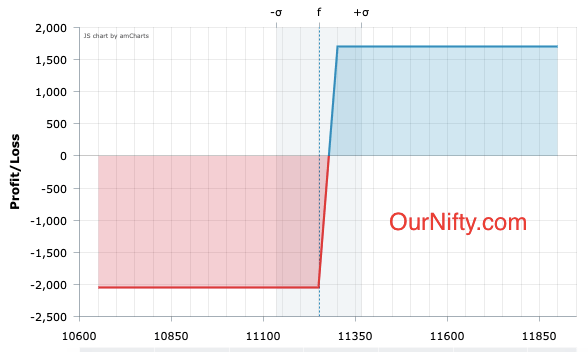

How to Use Options Open Interest Data to Find Trading Range of Nifty Future

Many traders told me that they find it difficult to judge the range of nifty future for short term, so today I am here with an article that will teach you how to find that exact top and bottom range for complete F&O series. First of all you should know what open interest is in Future and Option. I will explain this with an example: Trader A sells 1 lot nifty, trader B buys 1 lot nifty - Total ... [Continue Reading]