Nifty option is the most liquid option contract traded on NSE. Having a daily average turnover of about whooping $186 billion (Rs.15,80,000 crore). Nifty option selling is done when a trader believes that the option is going to expire worthlessly. When the options are really expensive then it is a good time to write nifty options rather than buying options. When the Implied volatility IV ... [Continue Reading]

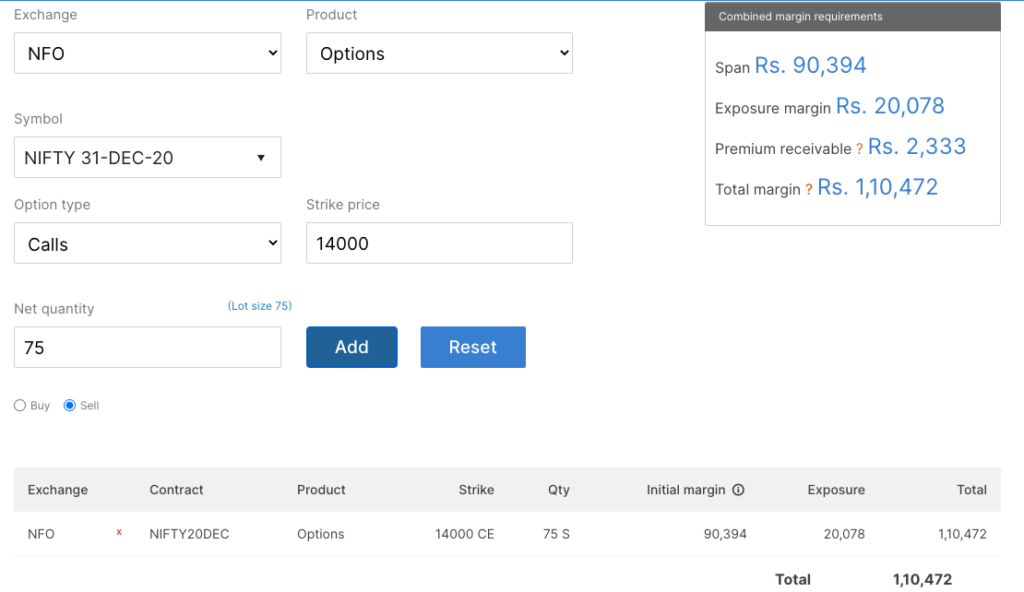

How Much Margin Capital Required to Trade 1 lot of Nifty Future

Nifty future is very popular among traders, many newbies want to learn to trade nifty future. But one that hits most in mind of a new trader, it is what is capital required to trade nifty future. Though capital requirement will be as low as 8% for the index such as Bank nifty future and Nifty future. Margins for Nifty Future: Margin actually varies from broker to broker. While most ... [Continue Reading]

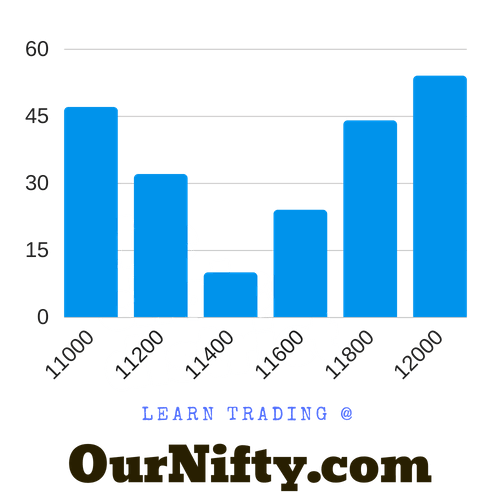

How traders across India make living from trading Nifty future contract

Nifty future is most popular futures contract traded on NSE (National stock exchange), traders usually make 25 points in intraday trade (day trading). So a intraday nifty future trader can make about Rs.20,000 per month, here is how. Let us assume that a trader make 25 points in intraday trading, suppose he trades 8 sessions only out of 22 trading session in a month. In intraday trading you also ... [Continue Reading]