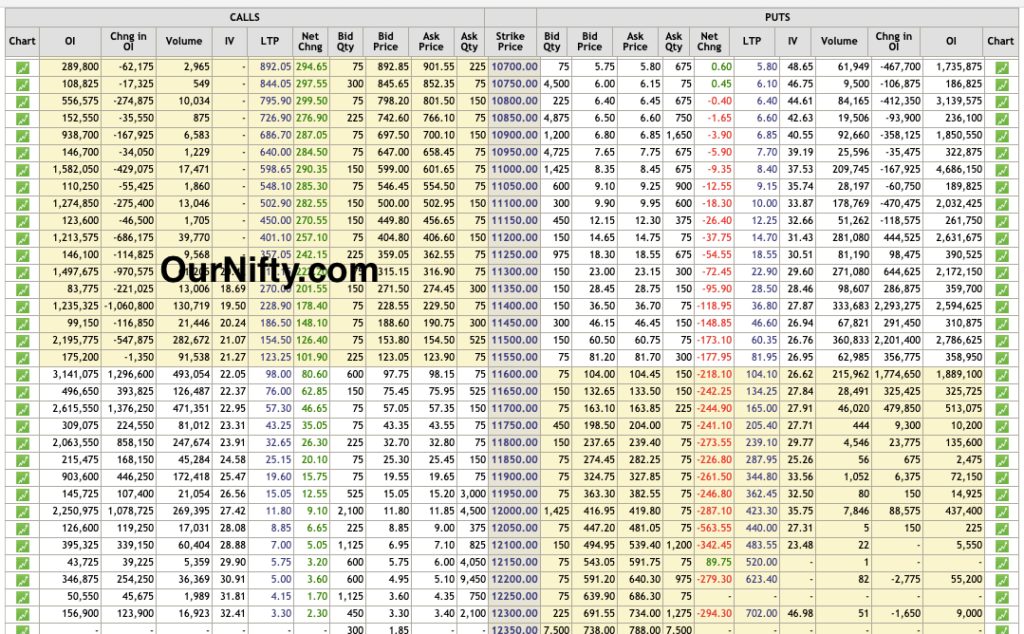

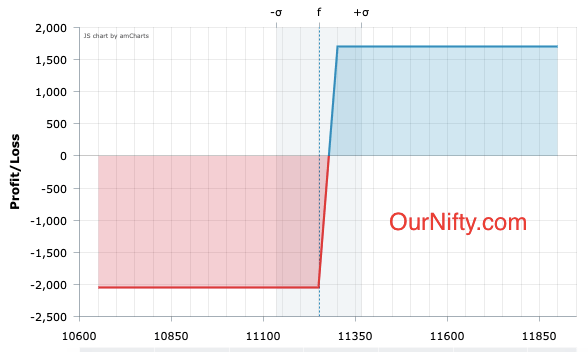

Nifty is most likely to go higher from the current levels. After the corporate tax cut. We are seeing huge buying in markets. We are expecting nifty has 1-2% upside room still left. But buying a future can be risky. So we are looking for options strategy with defined risk. In nifty one can deploy bull call spread, by buying ATM call option and selling higher strike call. This will bring the ... [Continue Reading]

Benefits of Trading with Risk Defined Options Strategies

Risk defined options strategies help to isolate the max risk to a certain comfort level. In trading future, we often place a stop loss to restrict losses. But what if our stop loss doesn't get trigger? scary right! Let us understand the risk with an example... We have found nifty future is trading at a support level, we are quite confident that nifty will not break this support. As it is a ... [Continue Reading]