Our markets have seen superb rally, nifty moving from 7500 to an all-time high of 26354. There are investors who are still looking to invest in the markets but couldn't find proper stocks. One simple approach should be to buy those stocks which are already trading cheap of their prices are low. Now since the prices are already low, they may not fall a lot. But if these stocks start to rise, ... [Continue Reading]

Upstox Brokerage Review in 2026 – Pros and Cons

Upstox (previously know as RKSV Securities), is one of the top discount broking companies operating at a zero brokerage model. Upstox was founded by Ravi Kumar and Raghu Kumar along with Shrini Viswanath. This brokerage firm now accounts for more than 2.38% of the daily turnover of NSE & BSE. It is around Rs.15,000 crore in daily turnover. Upstox offers a trading facility on major exchanges ... [Continue Reading]

Best Stock Brokers for Trading and Investing in India

Trading and investing in stocks is becoming more and more popular. Especially in small and growing tier 2 and tier 3 cities. Traders who are looking for actively trading in Indian stock markets are now looking for many dimensions. That can help them improve their trading experience. So knowing which is the best stock broker in India can solve many of the trading problems. We have done a thorough ... [Continue Reading]

How to Place Stop Loss and Profit Taking in Single Order

There is a saying that "Time and tide wait for none". Time is extremely precious, even in trading. An intraday trader must keep trade execution time and cost of trading at a minimum when adopting the scalping strategy. Many of the traders deal with a problem of not placing orders in a quick fashion. Like first they place an entry order and then placing a stop loss and then placing a profit booking ... [Continue Reading]

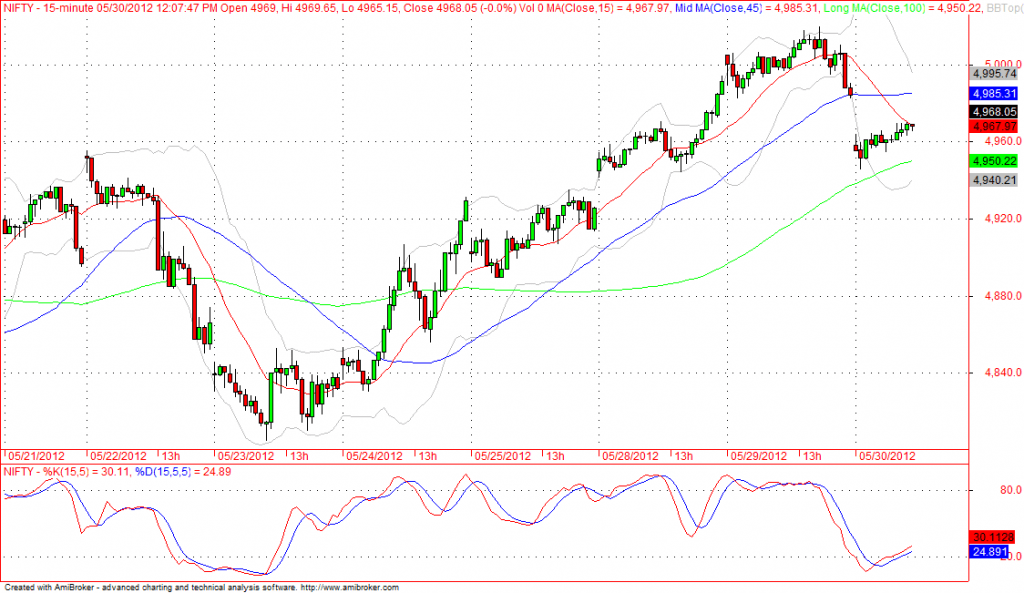

Benefits of trading in Nifty futures and Nifty options

I have been a lot busy to write research articles on Nifty future and nifty options. Today I am sharing why should a trader trade in nifty futures and options. There are several advantages of trading in nifty future and nifty options. About 75% of the total turnover in the NSE F&O market is generated because of Nifty (that’s a huge volume). Nifty futures and options have highly liquid ... [Continue Reading]

- 1

- 2

- 3

- …

- 59

- Next Page »