Dolly Khanna's Current Portfolio Dolly Khanna and her husband Rajiv Khanna are a few of the largest individual investors in the Indian stock market. In this article, we will find out what has worked out for this investor couple using their portfolio. They have made a fortune from investing. The portfolio details are updated on 1 January 2026. This is the latest holdings report. This ... [Continue Reading]

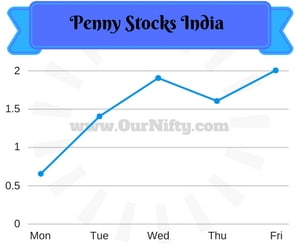

Penny Stocks List Traded in India on NSE for 2026

Penny stocks are highly infamous amongst the active traders. People often fall for these stocks and then finally realize that these stocks are worthless. These stocks are gaining good ground in the Indian stock market, as fresh inflows and liquidity driving the market higher and higher. After going through 1700+ stocks in NSE, we have compiled a list of penny stocks that are traded on NSE ... [Continue Reading]

List of Stocks trading below Rs.2 on NSE, Indian Penny Stocks

Friends here is a list of penny stocks that are trading in NSE and as all the stocks are trading below Rs.2 on NSE we see a very limited downside in them. Also Nifty future is continuously making higher tops and higher bottoms we see these stocks will also attract liquidity and may trade higher. So my advice will be to invest in these stocks, with a maximum total investment of Rs.30,000. These ... [Continue Reading]

Cigarette Manufacturer Giant: ITC is Low Beta Stock, Safe Investment in Stock Market

ITC Ltd. is India's largest cigarette manufacturer. It is one of the oldest listed company on NSE as it was listed on 23 August 1995. The stock has moved significantly in these years with lots of splits and bonus shares issued, it has made ITC one of the most valuable company in the FMCG sector. If we look at the charts of ITC stock then we see that it has made a recent all time high on 2 June ... [Continue Reading]

GAIL is in Strong Uptrend, Look for Buying Opportunities For Target as 515

GAIL (India) Ltd. being the largest gas produces in India is backed by its large gas assets. GAIL was listed on NSE on 2 April 1997. The daily chart suggests that there is some bearishness in the trend, so we are only looking for selling opportunity in this stock as long as it stays bearish, the pivot level is 440 so unless this stock closes above 440 we will be bearish. Selling GAIL futures below ... [Continue Reading]