Risk defined options strategies help to isolate the max risk to a certain comfort level. In trading future, we often place a stop loss to restrict losses. But what if our stop loss doesn't get trigger? scary right! Let us understand the risk with an example... We have found nifty future is trading at a support level, we are quite confident that nifty will not break this support. As it is a ... [Continue Reading]

Nifty options trading strategy for Interim Budget 2013 – 2014

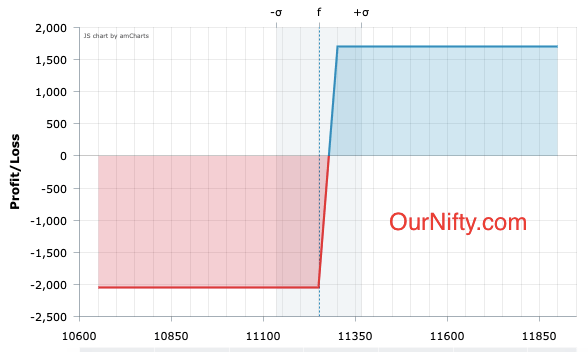

India's budget session in parliament has already began, we are hoping for new surprises from this budget. As this may be the last budget before the next general election. So it is more likely that Finance minister would be looking forward to bring in the reform in this budget, but if he fails to do so, then markets may retrace back lower. Hence, here exists very good nifty options trading ... [Continue Reading]

Short term Stock: Grasim is trading at support, Buy on dips

Grasim industries is another stock that is trading at a strong support level and is ready for up move, Stocks on weekly chart shows a up trend hence we only focus on buying opportunities. Recently slow stochastic has given a crossover on weekly chart so we are expecting strong buying here. Also the chart shows that there is support at 2929, which was a resistance previously. But as price action is ... [Continue Reading]

Trade using Gartley Pattern, Learn and trade patterns

Another interesting tradable pattern is the Gartley Pattern. The Gartley pattern one of those most traded pattern, which takes advantage of higher risk reward ratio. This pattern shows major reversal points in market, also it works with slowing momentum if not reversal. So most of the time you will apply this pattern in medium term chart like weekly chart. Fibonacci retracements play important ... [Continue Reading]

Nifty future range trading strategy: Trade Support and resistance

Here is short term range trading strategy for nifty future, hourly chart suggest levels of support resistance for short term: Strong support can be found at 5640 level, where as strong resistance 5720 level for nifty spot. So, one can buy nifty around 5640 level for target of 5700 and one can short nifty at 5720 for target as 5670 level. Stop loss will be, exit when nifty breaks out of this ... [Continue Reading]

- 1

- 2

- 3

- …

- 7

- Next Page »