London Stock Exchange (LSE) is one of the oldest stock exchanges in the world. So there are many listed lse penny stocks available for trading. LSE was established in the year 1801 as the first stock exchange in the UK. London stock exchange has more than 2400 listed companies. The total market cap is around $24 billion (£39 Billion). FTSE is the main benchmark index on the exchange. There are ... [Continue Reading]

BSE Penny Stocks List 2026

BSE Penny stocks are in great demand after the lockdown restrictions. Many new retail traders wanted to learn trading stocks, thanks to coronavirus. We are now seeing a whole new variety of traders looking to buy cheap stocks. These cheap stocks look attractive to new investors as they find blue-chip stocks have higher prices. Also, we have seen options trading activity has increased multifold ... [Continue Reading]

[UPDATED] Nasdaq Penny Stocks List 2026

Are you looking for penny stocks on Nasdaq to buy and hold? Since the lockdown due to the coronavirus pandemic, there’s a growing interest in the stock market trading. Most of the new generation traders are now trying their luck with penny stocks. The Nasdaq has hit fresh lifetime highs this year despite the crashes last year. Many newbie traders are looking for a list of penny stocks ... [Continue Reading]

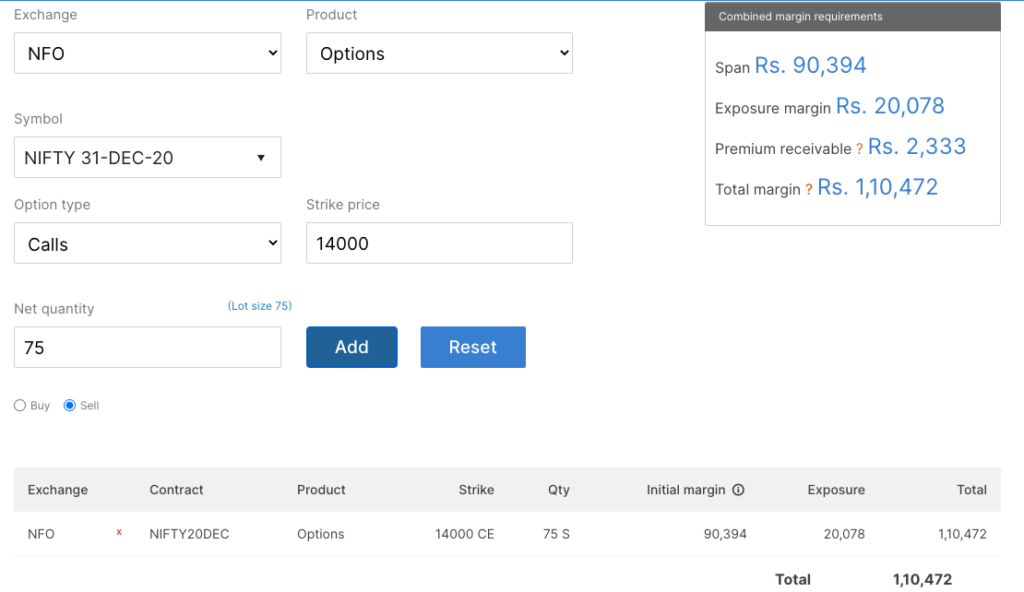

When to short sell Nifty options, how much margin required for Option Selling

Nifty option is the most liquid option contract traded on NSE. Having a daily average turnover of about whooping $186 billion (Rs.15,80,000 crore). Nifty option selling is done when a trader believes that the option is going to expire worthlessly. When the options are really expensive then it is a good time to write nifty options rather than buying options. When the Implied volatility IV ... [Continue Reading]

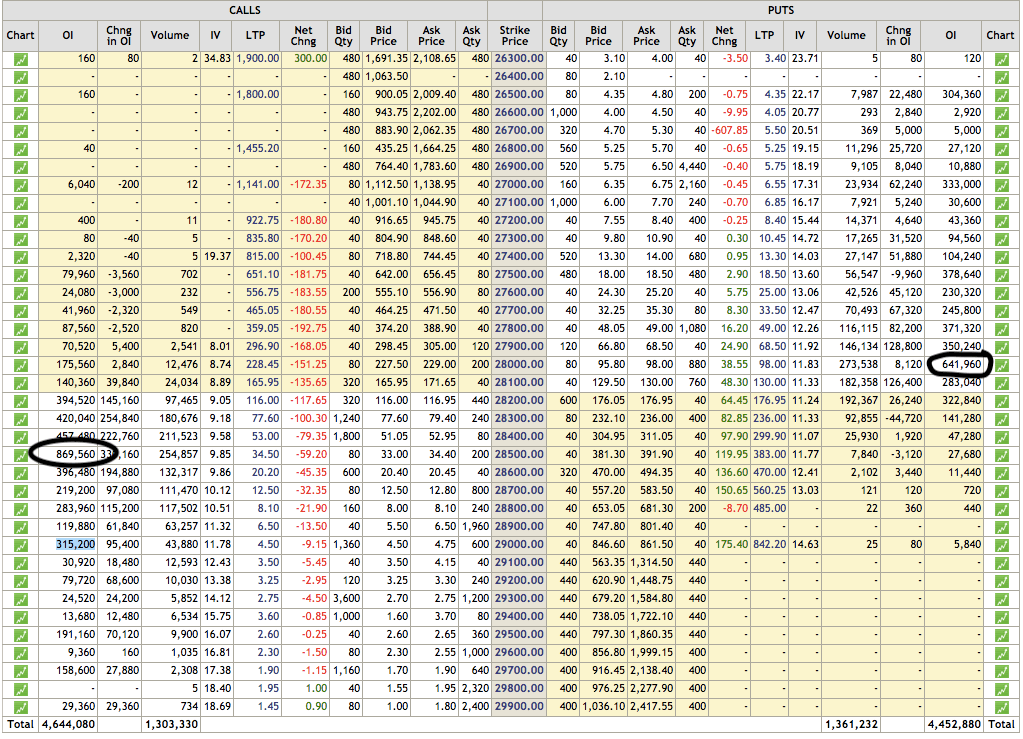

Bank Nifty Option chain trading strategy

Banknifty is one of the highly liquid and actively traded indexes on NSE. Banknifty options contracts also have a weekly expiry, which means you can trade 4 times every month. So bank nifty option chain is very active as well, trading in bank nifty option also requires less margin for option writing. This trading opportunity is unique because this week is having 4 trading sessions (15th August ... [Continue Reading]