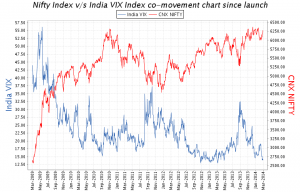

There is a strong inverse co-relation between nifty future and the India vix index (volatility index). We have seen that when the nifty has started to fall the vix was rising. As nifty option writers were of a view that there are chances that nifty reverse its move soon. That is why the volatility was increasing and not decreasing. Volatility has always remained high before the major economic events so that every move could be already priced in.

Higher volatility means more fluctuation in prices of underlying (nifty future in this case). This is actually bad for option buyers, and very good for option writers.

Lower volatility means a less fluctuation in prices i.e more clear direction (a clear trend on chart).

In the month of February, we saw volatility index testing a resistance level. This resistance was supplied by a declining trend line. So when this volatility declined, nifty future stated to move higher. Look for the below chart for VIX spot analysis.

Also, we are seeing Nifty future to show major moves in coming days, as volatility has increased sharply today. Open a low-brokerage trading account with us, we promise you of lowest brokerage in India.

Article updated on 18.08.18

Leave a Reply