Nifty option is the most liquid option contract traded on NSE. Having a daily average turnover of about whooping $186 billion (Rs.15,80,000 crore). Nifty option selling is done when a trader believes that the option is going to expire worthlessly. When the options are really expensive then it is a good time to write nifty options rather than buying options. When the Implied volatility IV ... [Continue Reading]

Nifty is bullish, Trade bullish view using nifty option spread Strategy

Nifty is most likely to go higher from the current levels. After the corporate tax cut. We are seeing huge buying in markets. We are expecting nifty has 1-2% upside room still left. But buying a future can be risky. So we are looking for options strategy with defined risk. In nifty one can deploy bull call spread, by buying ATM call option and selling higher strike call. This will bring the ... [Continue Reading]

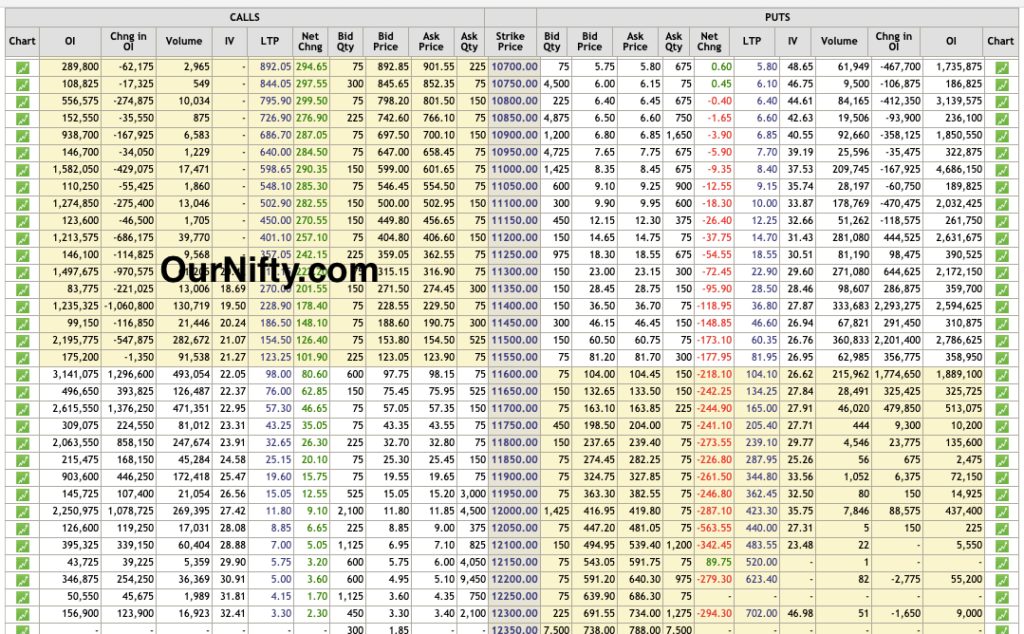

Positional Trading with Nifty Options Live Open Interest

Nifty futures has been quite volatile for almost three months now. We are just seeing a sideways move just before a new/fresh upside move. In this type of scenario we find trading in options quite risky, so to improve decision making we have introduced a new trading style in nifty options using Open interest. Yes, by using open interest data correctly any trader can generate handsome ... [Continue Reading]

Live Nifty Options open interest in Excel sheet

Nifty options are the most popular instrument to make a lot of money in trading. Nifty futures and options have the highest turnover than any other instrument traded on the stock exchange. Nifty option traders look for open interest to make any trading decisions. So, it is very important to study nifty options open interest on a regular basis. How to use Nifty Options open ... [Continue Reading]

Nifty Options trading strategy for Budget Session

Interim budget 2015 will be announced in parliament on Saturday, 28 Feb 2015. This will have a huge impact on the stock markets, currencies markets. It will be most closely watched by industrialist, corporate houses and also across the globe. The importance of this major event could be felt by the moves stock markets are showing in the last few days. Huge volatility is expected on 28th Feb 2015, ... [Continue Reading]

- 1

- 2

- 3

- …

- 11

- Next Page »