Nifty option is the most liquid option contract traded on NSE. Having a daily average turnover of about whooping $186 billion (Rs.15,80,000 crore). Nifty option selling is done when a trader believes that the option is going to expire worthlessly.

When the options are really expensive then it is a good time to write nifty options rather than buying options.

When the Implied volatility IV is high, options will be expensive.

Traders short sell nifty options when they see nifty future to be trading in a range. Also expecting that this range will continue to stay for some time.

In a ranging market, the nifty option trader can short sell:

- Out of money nifty call option

- Little far out of money nifty put option.

Keeping these strike prices at least 1 standard deviation away. So the probability of being profitable is at least 68%.

Now let us find out how much margin is required for writing a nifty option. In other words, for selling nifty options.

Margin for Selling Nifty Options:

Short selling nifty options require margin equivalent to nifty future. So if we want to short sell nifty option we need ~Rs.1,40,000 per 1 lot. Yes! you read it right that’s ~Rs.1.4 lakh for 75 quantity.

This is because naked option writing has unlimited risk. Profit is limited to the premium received at the time of selling the nifty option. But if you hedge this position by buying a far out of money option, then the margin requirement will be much lower.

In case of spread strategy, this margin requirement can go down by ~85%.

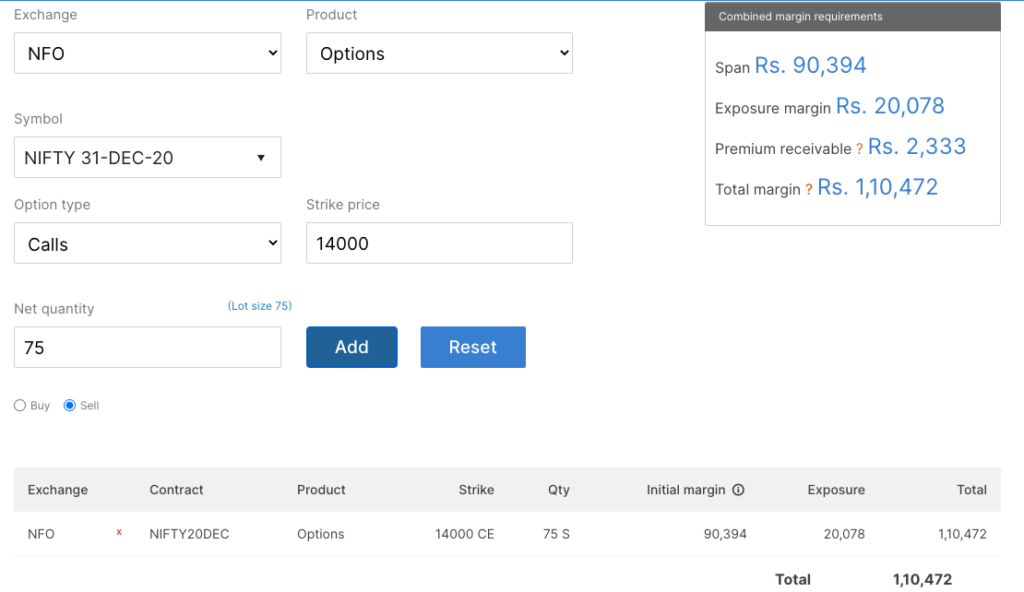

The margin for naked option selling:

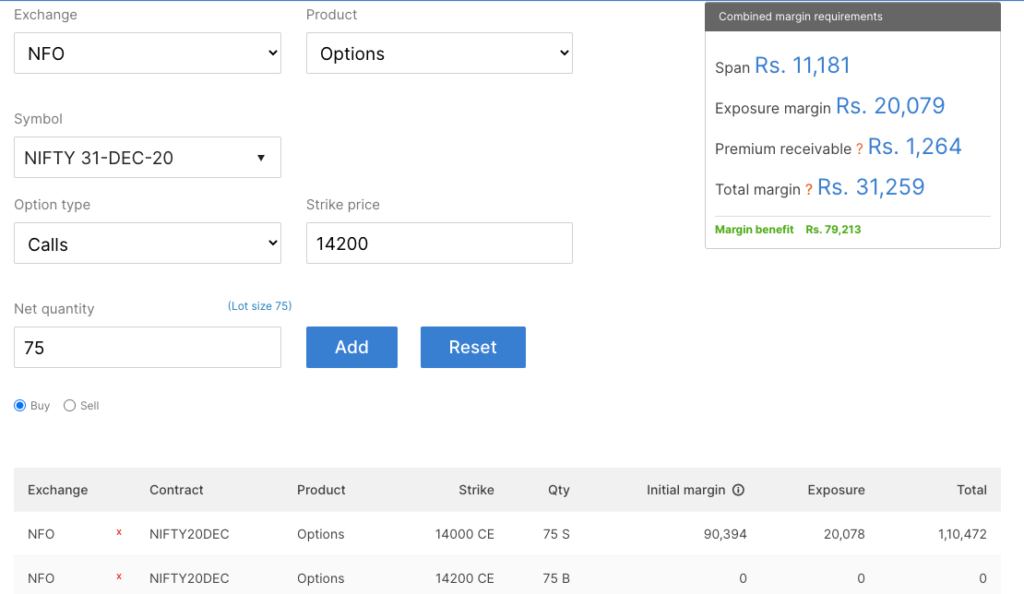

The margin for selling nifty option with hedging:

The positional margin for selling options is decided by the stock exchanges. So all brokers will offer the same margin for positional trade. Whereas intraday margin depends on the broker you are trading with.

Option Greeks and option strategies are difficult for a new trader. Now you can learn options trading in a simple way. Check this Online Options Trading Course, the fee is Rs.6500 only.

I am currently trading with Upstox. Upstox offers multi-leg options trading strategy execution in just 1 click. Lowest brokerage in the industry. Simple and powerful charting platform and much more.

Can you please tell me how much margin is required for nifty call option and put option for one lot. How much shares are in one lot

Can u pls teel me how much margin is required for short sell of call option for one lot?

Please answer someone

Your opinion on binary trading differs from most of the

blog posts I browse, I am delighted.

what is margin to sell banknifty options (option writing)?

why does the margin to sell an options is higher than the buying an option. I was looking like what is the logic in that?

which broker asks for least margin for trading options, i am interested in the nifty and banknifty options only?

I am mostly a swing trader, holding positions for few trading sessions.

if sell nifty options trade is profitable, then why it is said that risk is less in buying a options than selling the options.

i was looking for a broker that gives me margin for intraday in selling options. like 10x or 20x, do you know any such brokers?

what are the chances if i buy a nifty options then i will make and money, and if i sell an option i will make money.

Which side do you think is the riskiest and why?

I am a intraday trader, but for intraday there are no strategies in nifty options. I have lost lot of money in buying options and they lost value on expiry day. Do you teach options trading?

i am interested in options trading strategies. call me after 6pm

what is best time to sell an options (option writing)? Beginning of the month or ending?

i am nifty futures trader, recently i have started with options trading.

i am interested in nifty options strategies which require less margin. i currently trade in banknify future.

I have been trading nifty options for years now. From my experience, selling options with correct strategies will make you more than buying an option.

Margin required for 1 lot of selling nifty options is around 50000-53000, margin varies from broker to broker, I would recommended you to try any discounted broker.

what is margin required to short sell banknifty options? I need both intraday as well as positional margin.

selling options are key to success… practice along with depth knowledge will surely help in writing…