Risk defined options strategies help to isolate the max risk to a certain comfort level. In trading future, we often place a stop loss to restrict losses. But what if our stop loss doesn’t get trigger? scary right!

Let us understand the risk with an example...

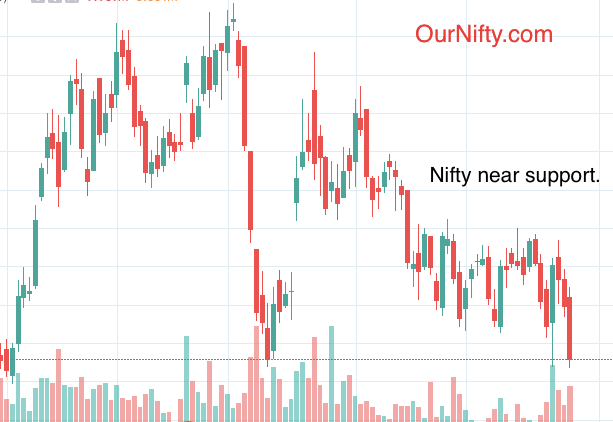

We have found nifty future is trading at a support level, we are quite confident that nifty will not break this support. As it is a very strong support level.

So normally our trading strategy would be to buy nifty future as close to this support level. Let us assume we are buying nifty future near 11610.

Stop loss for this trade should be a few points below the support level. So that if support breaks we should be out of this trade. Here the support level is at 11600, so stop loss should be around 11580. The predefined risk in the trade is just 30 points.

Now we will find the targets/profit booking levels. The golden rule is a target should be at least 2 times of the risk or at the next resistance level. So we will be placing target 90 points above our buying level. Target level is 11700 (next resistance).

In this trade, we are getting excellent risk : reward ratio i.e 1:3. Feels good, right!

But there is a problem with these types of trades, what if…

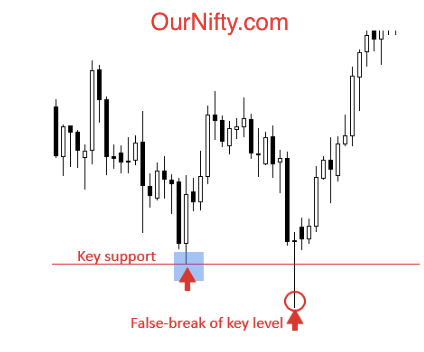

- Nifty futures open gap down next day and even below our stop-loss level. What to do now as the loss would be increasing and stop-loss order won’t be triggered. In this scenario, a trader may see unbearable losses, even after following the risk management rules.

- Next possible scenario would be, A stop loss gets hit and you are out of the trade, but then nifty futures rebounds and moves towards the target level. (Big guys had targeted our stop loss area.)

We can solve the above problem by using the options spread strategy.

An option spread is 2 leg strategy, which is a combination of a buy option and a sell option. Will show in detail example.

Since the support in nifty is at 11600, we will be buying nifty 11600 call option @ 65. But to reduce the cost of this option we will also sell 11700 call option at 40.

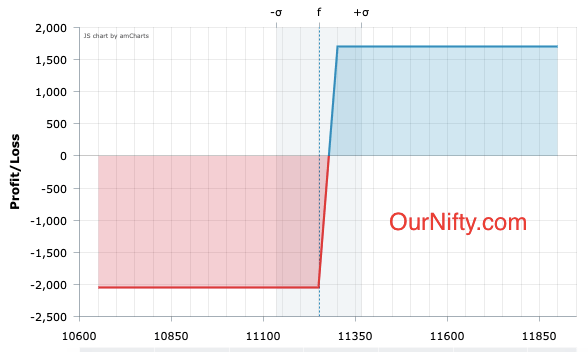

Now we have 2 positions open, here is the calculation.

- Buy Nifty 11600 CE @ 65 (Debit)

- Sell Nifty 11700 CE @ 40 (Credit)

- Here 65-40 = 15, Now the cost of this trade is just 15. (Down from 65)

- Risk is just 15. Even if next day nifty open 200 points down. So we have completely eliminated downside risk.

- This is called a risk defined options strategy.

In Risk defined strategies, we don’t have to place any stop-loss order. As the combination of the option legs will help to restrict losses.

If nifty open down by 200 points…

If nifty gaps down by 200 points then, our positions will be:

- Buy nifty 11600 CE @ 65, will be trading at 0 on expiry.

- Sell nifty 11700 CE @ 40, will be trading at 0 on expiry

- We have paid a total premium of 15 in this trade, that will be our maximum loss.

- No matter how low the market moves, the loss is restricted to 15 points only.

Check Best Books on Trading.

If nifty opens gap up by 200 points…

If nifty gaps up by 200 points then, our profit will be:

- Buy nifty 11600 CE @ 65, will be trading at 200 on expiry.

- Sell nifty 11700 CE @ 40, will be trading at 100 on expiry

- We are making 200 points profit in the 1st leg and 100 points loss on the 2nd leg. So the total profit will be 200-100 = 100. But we have paid 15 points while entering the trade.

- So our final profit will be 200-100-15 = 85 points.

- No matter how high the market goes, our profit will be locked at 85 points.

An option spread strategy helps to restrict our losses as well as profits. As even before entering the trade maximum profit is known and even the maximum loss is known. Risk management is easy.

In the nifty future example, we have seen the drawback of using a stop-loss order. Using options both the drawbacks of stop-loss are completely resolved. Even I am a full-time options trader, so I may be biased towards options. 🙂

The only drawback is the ROI would be lower than buying the nifty future. But that should be ok, as we are more focused on managing the risk.

Leave a Reply